How to Sell Me on Investing in Your Startup

As an angel investor and startup mentor, I hear a lot of startup pitches. To be blunt, most aren’t very good.

They might have beautiful graphics and the right words on each slide. Most follow a template with the right information. And yet, most fall flat because they’re missing the point. In fact, they fall flat because they’re following a template instead of focusing on the point of the pitch.

What, then, is the point of a pitch? Why are you sending me a pitch deck and spending most of your day hunting for investors? You want money, of course. But what does an investor like me want?

Will I invest in a startup because it has a great product? No. A great product is necessary, but not sufficient. It’s not the reason I invest.

Will I invest in a startup because it has a great team? Again, necessary but not sufficient.

How about an important social impact? A huge carbon reduction? Diverse founders? Support the community? Points in favor, for sure, but not the point.

So why do I invest? It ought to be painfully obvious — I invest in startups to make money.

When you pitch to me, you need to show me why putting money into your startup is a good investment.

Never forget you’re selling something — stock in your business.

I’m looking to buy something — stock in a startup — that you’re looking to sell. Instead of thinking of the pitch as a way to cram as much information as possible about the business into 10 minutes, think of it as a sales presentation selling stock instead of software.

Like any other sales presentation, you need to show why I should buy your stock instead of that of another startup. (Hint: it has the best risk vs return profile.)

Stand up and declare, “Our startup will not only be the 1 out of 10 investments to succeed, but I guarantee it’ll be the best investment you’ll ever make.”

Great. You’re halfway there. That’s a perfect wrap-up statement. Now use the other 10 minutes of your pitch to prove it.

The 3-Legged Pitch Stool

Proving the startup is a great investment consists of 3 distinct ideas. The pitch needs to cover all 3. Without one of these sections, the pitch is like a 3-legged stool with a broken leg.

1. The Current Product

What is the company building and why? A great investment starts with a big market need. Slides include:

- Problem

- Solution

- Market opportunity

- Current traction

2. The 5 Year Growth Plan

You’ve got a great product. Now show me how you’ll turn that into a business with $100M in revenues within 5 years. Slides include:

- Important milestones

- How you’ll reach millions of users

- Competition

- IP strategy or moat to keep competitors from copying you

- Team that can build and scale the business

- 5 year revenue projections

3. The Investment

You’ve only a got a killer product and a can’t-fail plan for growth. Now you’re ready to prove the most important point — that buying stock in the company is a great investment. Slides include:

- Exit strategy with comps — who’ll buy the business and what are typical metrics for acquisition

- Investment history including past investment and future finance needs

- Deal terms including amount raising, valuation, financial instrument, deal lead and amount of round already closed or soft-circled

This list is specifically for a seed/pre-seed pitch. Once the company is raising Series A, the pitch needs to be modified a bit. Current traction becomes critical with investors wanting to dig into details of revenues, growth, customer acquisition costs, and churn. The exit strategy can be left off when talking to industry funds that know the exit environment better than you.

Template vs investment pitch

Let’s consider the team slide as an example. Every pitch deck has a team slide. Most are not very good.

The team slide usually fails because it’s just a list of managers and advisors. It shows their role and the various companies where they’ve work. Like the rest of a pitch, my reaction is “so what?”

You’ve told me who the team is, but you need to convinced me it’s the perfect team not only to build the product and business, but to generate a big financial return to investors.

Has the team led previous startups to successful exits? Have they built a highly-functioning organization from scratch? Do they have specialized industry expertise that competitors can’t replicate? Highlight those points and leave out everything else.

A startup might have 10 advisors. Do we care who the lawyer and accountants are? Usually not. A few advisors who are incredibly helpful and insightful? Great to have but investors don’t know them, best to leave them off the deck. Working regularly with an advisor who’s built the biggest startup in same space? A founder of Tesla? Let’s hear more about those relationships and leave out everyone else no matter how useful they actually are.

If this sounds like window dressing, it is. Your pitch is the display window for your store where you’re selling stock. You can’t fit everything in the window, so make a statement here to convince us to come inside and see the details in due diligence.

A Pitch to Leave Us Drooling

The best pitches not only convince investors that the company has a good product and a good business, but that this is a chance to get in early on a once in a lifetime investment opportunity.

Aim to leave investors not only interested in investing in the company but drooling to do so. Not only asking for more information, but begging to take their money.

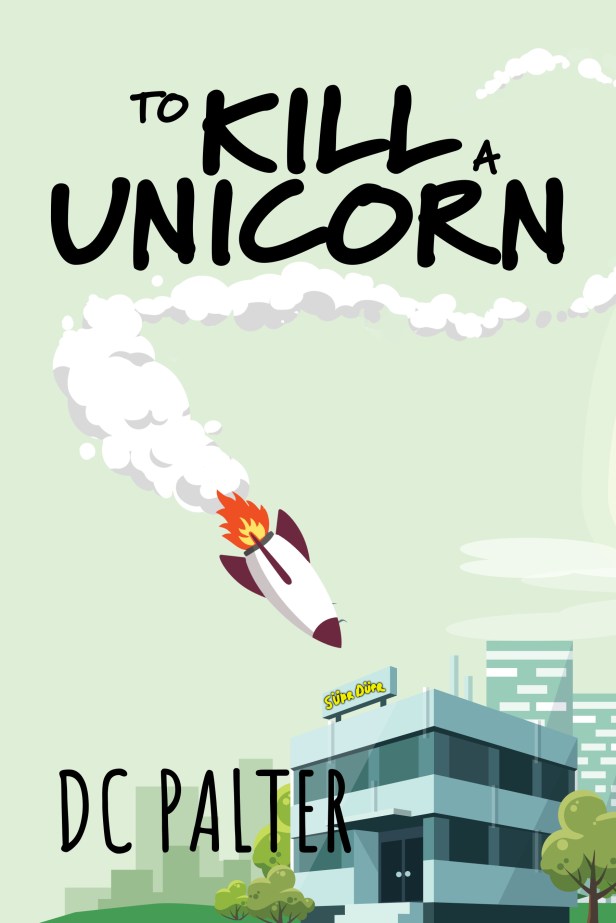

To Kill a Unicorn – a Silicon Valley Mystery

Interested in startups? You’ll love my mystery novel about SüprDüpr, a Silicon Valley startup that claims to have invented teleportation. Now the chief scientist is missing, and his friend has to find out if the company is a fraud or hiding fatal side effects of their technology.

Order your copy today!

https://www.amazon.com/Kill-Unicorn-DC-Palter/dp/1950627616