How to Nail the Elevator Pitch

The elevator pitch isn’t just an exercise — it’s your introduction. Here’s how to nail it and hook investors.

How to Reach Out to Early-Stage Investors

Most investor reach out gets no response. Here’s how to do it right and get attention from investors.

What Stage Founder Are You?

To succeed as CEOs, we have to take advantage of our strengths and be honest about our weaknesses. And eventually, we may have to step aside and let our creation grow without us.

7 Things Experienced Founders Know that 1st Time Founders Miss

The 7 pitfalls that trip up first-time founders that experienced founders know to anticipate and evade.

How to Get Investors Excited About Your Market Opportunity

What you need to know about market sizing and how to provide the information investors are looking for in your pitch.

How to Make Corporate Venture Capital the Solution to Your Funding Needs

Corporate Venture Capital can be an important source of funding that offers unique advantages. Understand the benefits of CVC investments and the complications.

The Changing Focus of Venture Capital Funding

The dominance of software has recently waned among angel investors with life sciences accounting for more than half of our investments.

10 Takeaways for Angel Investing Success

I’ve invested in over 100 startups. Here’s what I’ve learned about what works in angel investing and what doesn’t

How Big is the Market for Your Product?

Understanding market sizing and how to present it to investors.

The Myth of Warm Introductions

A warm intro might get you a connection, but won’t help much in landing an investment. Here’s what to do instead.

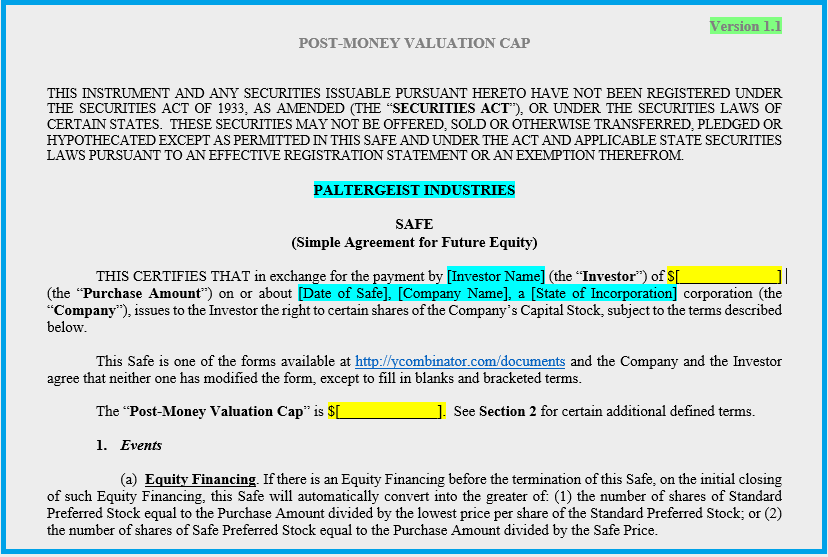

Why You Should Embrace the Post-Money SAFE and Avoid the Pre-Money SAFE

The post-money SAFE is the best vehicle for investing in early-stage startups, while the original pre-money SAFE is a non-starter. Here’s why.

How Much Money Can a Startup Raise from Investors?

How much capital can you can realistically raise at each stage?

5 Tips for Startup Sales Success From the World’s Worst Salesperson™

At the early stages, it’s up to the founders to do the sales. Here’s my tips on how to be successful at sales without being a good salesperson.

The 5 Reasons You Should Become a Startup Founder

Here’s the 5 reasons why you’d be a great startup founder, and the biggest reason many people want to be founder who shouldn’t.

How to Pitch to Angels—Your Early Investors

Angels are the first investors in most startups. Understand who we are and what we’re looking in this article.

Why Do Venture Funds All Chase After the Same Startups?

Understanding VC groupthink and how to use it to your advantage Apologies to my many VC friends. I don’t mean to insult or disparage you in any way. You’re all not only brilliant, creative, and successful individuals, but caring and generous people (well, most of you.) The reason venture funds chase after startups in the…

5 Keys to Marketing to Consumers on a Budget

The 5 keys to crafting an effective consumer marketing strategy.

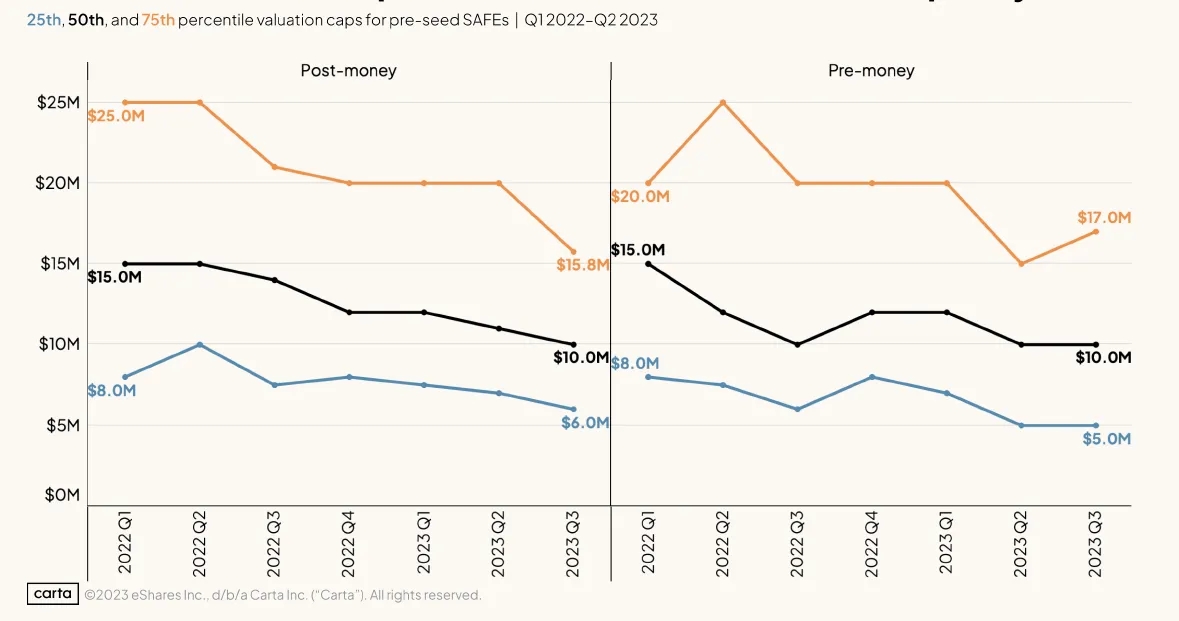

Pre-Seed Valuations Are Down 1/3 Since Last Year

5 key takeaways from a Carta report on 2Q2023 valuations and funding of pre-seed/seed startups

How to Fund Your Startup in a Tough Venture Environment

Here’s how to raise early stage funding for your startup in the difficult current venture environment.

How to Pitch Like a Pro, Even if You Aren’t

Amateurs pitch that their startup will succeed; professionals show how their startup cannot possibly fail.

Is Your Startup a Good Fit for Venture Capital?

Make sure your startup meets these 5 criteria VCs look for before spending months pitching them for funding..

How to Negotiate a Startup Valuation

When you pitch to investors, you need to specify the valuation. But how do you negotiate a suitable valuation?

The Startup Business Plan: How Will You Reach $100M in Revenue?

Startups need to show how they’ll reach $100M in revenues to be suitable for venture investment. Thinking through how to hit that critical metric provides a framework for difficult decisions.

How Will You Reach Millions of Customers?

Go-to-market means getting a product into $100M of customers a year. How are you going to do that?

Your Pitch Deck Has 1 Minute to Sell Me

When I open a pitch deck, I scan it for a minute. Or less. Here’s how to grab my attention.

The 3 Legs of a Startup Pitch That Leaves Investors Begging For More

The pitch consists of 3 legs: the product, the growth plan, and the investment. Be sure to cover all 3.

Why Startups Need Both a Builder and a Visionary

What a startup needs besides a great idea is perfect execution. That’s why in addition to a visionary, a startup needs a “builder.”

What a Cupholder Says About Competing with Giants

It can be difficult to take on giants head-on. But the giants also can be incredibly myopic. Here’s how to beat them.

Why Startups Need a Lead Investor

There’s a lot of work required to be the lead investor, from negotiating the terms to doing a review of the company to serving on the board. Find a good lead investor first and other investors will be comfortable following on.

What a Waffle Says About Competition

Having a better product isn’t always enough, especially if there’s an industry giant that can make something customers find good enough.

Why is HardTech so Effing Hard?

If there’s one overriding reason why almost no hardtech startups have become unicorns, it’s this: building a hardtech startup is really effing hard.

The First Money is the Most Expensive Money

The most frequent question from founders preparing for their first raise is: how much should we raise? The answer: as little as possible.

Startups — Throw Away Your Customer Slides

The most common mistake founders make is adapting their customer presentation into an investor pitch deck. But you need to start fresh for a different audience.

Everything Startups Need to Know About Convertible Notes

The convertible note is a shortcut for startups that aren’t ready to bite off on issuing preferred stock. It’s more flexible than a SAFE, but there are many details to understand to avoid making critical mistakes.

Everything Startups Need to Know About the SAFE Agreement

The SAFE agreement is the best structure for an early-stage investment. Here is everything you need to know about it.

Should You Join a Startup Accelerator?

There are hundreds of accelerators claiming to help startups get off the ground. Should you join one?

Why I Hate Liquidation Preferences

Liquidation preferences seem like a minor detail on the term sheet, but other than the valuation, they’re the most important term. Founders need to understand what they’re agreeing to.

Surviving Advisor Whiplash

As you work with mentors, you’ll get a lot of great advice, but some will be contradictory or useless. Here’s how to avoid advisor whiplash.

Why Every Startup Founder Needs to Study This One Book

Accounting isn’t just a tool for paying bills – it’s the process of analyzing the health of a business, and every founder needs to understand it.

The Key to Becoming a Successful Startup Founder

Want to build a startup but haven’t done it before? The best way to get started is to join a funded startup as an early employee.

Why Every Startup Needs a Lawyer From the Start

Every startup needs a lawyer. Right away. From day 1. And not just any lawyer but a lawyer who specializes in venture-funded startups. You’ll save yourself a whole lot of aggravation and wasted time.

Sorry, Startups — Investors Won’t Sign Your NDA

Venture investors won’t sign NDAs. Here’s why, and how to work around it.

How to Turn Customer Support Into a Company’s Profit Center

Being a startup is difficult. But startups have one advantage that makes all the difference — we care. And great customer support is how we prove it.

Why Using an Agent for Fundraising Is a Deal Killer for Startups

Investors avoid investing in startups that are using agents to look for funding.

Is Project Finance the Way to Fund Your Startup?

Venture capital is not the only way to build a startup. When the business involves hard assets that generate profits, project finance may make more sense.

Why Pitch Deck Design Matters

Pitch deck design matters. It’s a critical signal for the quality and professionalism of the startup. So spend time and even money making it attractive and easy to follow.

The Best Startups Begin with a Desperate Need to Solve a Problem

The most successful startups begin with a founder with a desperate need to solve a particular problem.

How to Raise a Pre-Pre-Seed Round

Need to raise funding for your startup, but are still pre-revenue? Angel investors will say you’re too early for them. Welcome to the “pre-pre-seed round”

Why the CEO of a Startup Needs to be a Marketing Expert

This is why the CEO of most startups should be a marketing specialist.

8 Traits of Successful Startup Founders

Everyone wants to be a startup founder. But not everyone is cut out for the life. Here are the 8 traits of successful founders.

Why VCs Hunt for Startups With the Potential for 100x Returns

Venture investors have a reputation as greedy bastards preying on poor startups. But venture investors are looking to make money investing in the high-risk, illiquid stock of early-stage startups. The numbers only work with a big exits of 100x or more.

The Killer J-Curve

For early-stage startup investing, the J-curve is a killer. The failures fail quickly while the successes can take a decade to show any return.

The Highest Valuation Isn’t Always the Best Valuation for a Startup

Higher valuations are generally wonderful. But if the valuation is too high, it can kill the company in later rounds. Here’s how to find the best valuation for a hot startup without getting overvalued.

Why I Only Invest in US-Based Startups – And What to Do If Your Startup is Located Outside the US

As a US taxpayer, investing in corporations outside the US is difficult. Here are the 3 reasons why, and what you can do about it.

How to Get Funded by Angel Groups

Angel investment groups are the biggest source of funding for startups at the pre-seed/seed stage. groups operate and think of them as an early-stage VC. Founders who understand how angel groups operate are far more successful at raising funding.

How Do You Calculate the Valuation of Your Startup?

What is the valuation of a startup? It’s the amount investors are willing to pay. It’s best to think of company valuation more like an auction than the purchase of public stock.

How to Hook Investors From the Start

A pitch begins with a description of the problem and solution. You either hook the audience immediately or leave them lost from the beginning.

The 11 Slides of a Perfect Pitch Deck

The pitch deck provides investors with a summary of your business. It needs to be comprehensive while succinct and tell a cohesive story.

Why It’s Better to be a Leader in a Niche Market Than a Small Player in a Huge Market

Here’s why dominating a niche is a better business plan than targeting a small sliver of a huge market.

When is the Time to Quit Our Job and Go All-In on Our Startup?

When is the right time to go full-time on a startup? There’s no right answer for everyone, but here’s how I made my own decision.

6 Ways to Get Past “You’re Too Early” Rejections

The biggest challenge for startups is the earliest stage. Here’s how to find funding in the earliest stages before you’re ready for a seed round.

9 Marketing Hacks to Grow Your Business On a Budget

Creating a great product is only half the battle. Now you need to market it so customers can find it. Early-stage startups don’t have much money to spend. Here is how to build a startup on a tiny budget.

10 Ways to Fund Your Bootstrap Startup

The biggest challenge of bootstrapping a startup is funding. Here are 10 sources of funding to make launching your startup possible.

6 Reasons to Bootstrap Your Startup Instead of Taking Venture Capital

But before starting down the path of raising venture capital, startups should consider the possibility of bootstrapping instead.

How Startups Can Leverage Resellers to Reach Customers

Distributors and resellers can help a startup find a wide audience, but the company has to drive the sales process itself to succeed.

Understanding the Difference Between Angels and Venture Capitalists

Understand the differences between angels and venture capitalists, and the different motivations and constraints each have for investing.

How to Avoid Getting Burned by a Pre-Money Valuation Cap

Even long-time angel investors tend to think of company valuations as a single number. But there are two numbers: the pre and post-money valuations. That detail is important to understand to avoid getting burned like me.

Startups: Don’t Waste Your Time Pitching Without a Valuation Cap

Don’t waste your time pitching on an uncapped note or SAFE. If your terms don’t include a reasonable valuation cap, I won’t be investing.

How to Choose the Right Financial Instrument to Attract Investors

The choice between SAFE, Convertible Note & Equity is as important as the terms.

14 Reasons to Reject a VC’s Investment

My 14 reasons to turn down an investment from a VC and look for another partner.

Founders: Avoid Getting Scammed by Fake Investors

Founders beware! Scammers are targeting startups with sophisticated scams posing as fake investors. Learn how to avoid losing your money to criminals.

How Much Should Startups Pay Their Key Advisors?

Startup advisors need to be compensated with stock options. Read how much is appropriate and how to structure it

Licensing vs Direct Sales: Which is Right for Your Business?

HardTech startups have to choose between licensing their technology and selling products to customers before taking investment. Understand the complex trade-offs to choose the business model that’s best for your business and goals.

How Much Should Founders Pay Themselves?

What is a suitable salary for a startup founder? Find out in this article.

How SPACs Transform the Prospects for Early Stage Startups

Think SPACs are only of interest to Wall Street investors? The SPAC craze is having a huge impact accelerating early stage investments.

A Tale of Two Pitch Decks

You need two versions of your pitch deck – one for presenting in person and one for sending out. Understand what material you need to include in each.

The Real Reason Your Startup Needs an Investor on the Board

Here’s the real reason you absolutely need an investor on your board of directors.

Why Your Startup Needs to be a Delaware C-Corporation

Everything a founder needs to know about corporate structure.

How Japanese Deer Taught Me to Master Sales

Understanding the difference between the end user, customer, and decision maker is key to mastering sales.

A Plea to Startups from Your Angel Investors — Tell Us Your Bad News. Please!

Startups! This is a plea from your angel investors. Keep us in the loop, bad news and all!

What’s a Lifestyle Business?

Businesses built for profitability rather than growth are great for founders, but leave investors in a pickle.

Why Early-Stage Startups Shouldn’t Hire a Head of Sales

Early-stage startups need to always be discovering. Which means the job of sales needs to remain with the CEO.

The One Thing That Separates Great Pitches from Amateurs

What separates great pitches that attract investors from the vast majority that don’t? The one thing to get right is…

Why Angel Investors Shouldn’t Invest in the “Angel Round”

For startups that will need huge amounts of capital, investing in the seed round as an angel investor is best avoided.

The Most Important Word in Your Pitch is… ‘Imagine’

Unleash the power of storytelling to let investors experience the world through your users’ eyes.

Why YC-School’s ‘Go Big or Go Home’ is Wrong

Go Big or Go Home is the wrong advice for many startups. Here’s why you shouldn’t change your business plan to meet venture funding models.

How to Fund a Startup If It Isn’t a Rocketship

How do you build a startup if you can’t get venture funding? Learn all the options to get started here.

Why Startups Need Projected Revenues Over $25M

Venture investors require startups to have projected revenues of at least $25M by Year 5. Find out why.

Finding Pre-Seed Investors

Who will fund your pre-seed round? It’s not angels and VCs but people in your network and industry insiders who understand what you’re building.

What’s My Valuation?

What’s the valuation of your startup? It all comes down to how attractive the investment is compared to all the other startups.

The Pitch Deck: Slide 11 — Deal Terms

Wrap up your pitch with your ask – buy our stock now, and tell us the terms of the deal!

The Pitch Deck: Slide 10 — Exit Strategy

The pitch needs to answer the question: is this a good investment? And that boils down to the exit, when the investor makes a return.

The Pitch Deck: Slide 9 — Revenue Projections

5-year revenue projections are complete fiction, and yet, absolutely necessary to your pitch. Here’s why.

The Pitch Deck: Slide 8 –Traction

The best way to get investors excited in your business is by showing traction

Three Ways to Get Funded Without an All-Star Team

Here’s how to get funded if your startup team doesn’t makes the VC’s drool.

The Pitch Deck: Slide 7 — Team

The three most important factors in startup success are the team, the team, and the team. But what exactly are we looking for in a team?

The Pitch Deck: Slide 6 — Competition

What we want to hear is not that you have no competition, but how you’ll prevail over all of them.

The Pitch Deck: Slide 5 — Competitive Moat

To keep out competition, you need a moat. Learn how to build a moat that’s wide and deep, and stocked with alligators to build an enduring advantage.

The Pitch Deck: Slide 4 — Go-to-Market Strategy

Wrap up the introductory third of your pitch by connecting the dots between your wonderful product and the millions of people who need it.

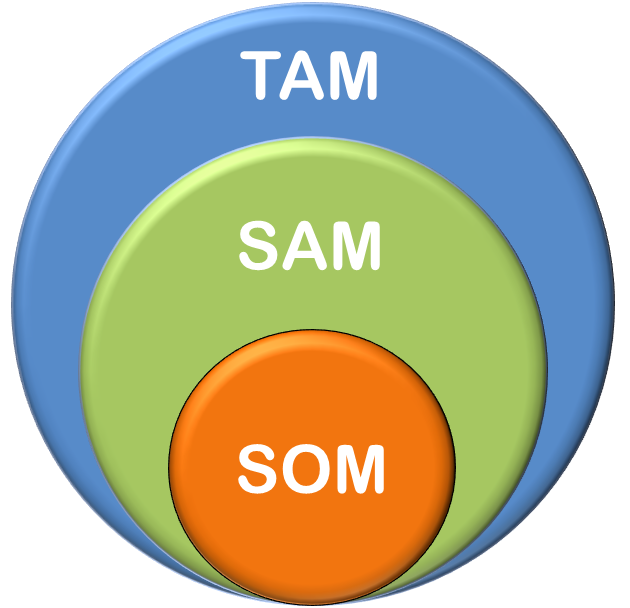

The Pitch Deck: Slide 3 — Market Sizing and TAM / SAM / SOM

In theory, market sizing is simple, but it rarely actually is. This article reviews the TAM/SAM/SOM model for market sizing, but recommends alternatives that are often better suited for the real world.

Subscribe to receive your insights weekly